Money 2025

Follow-up to this Medium post on personal finance.

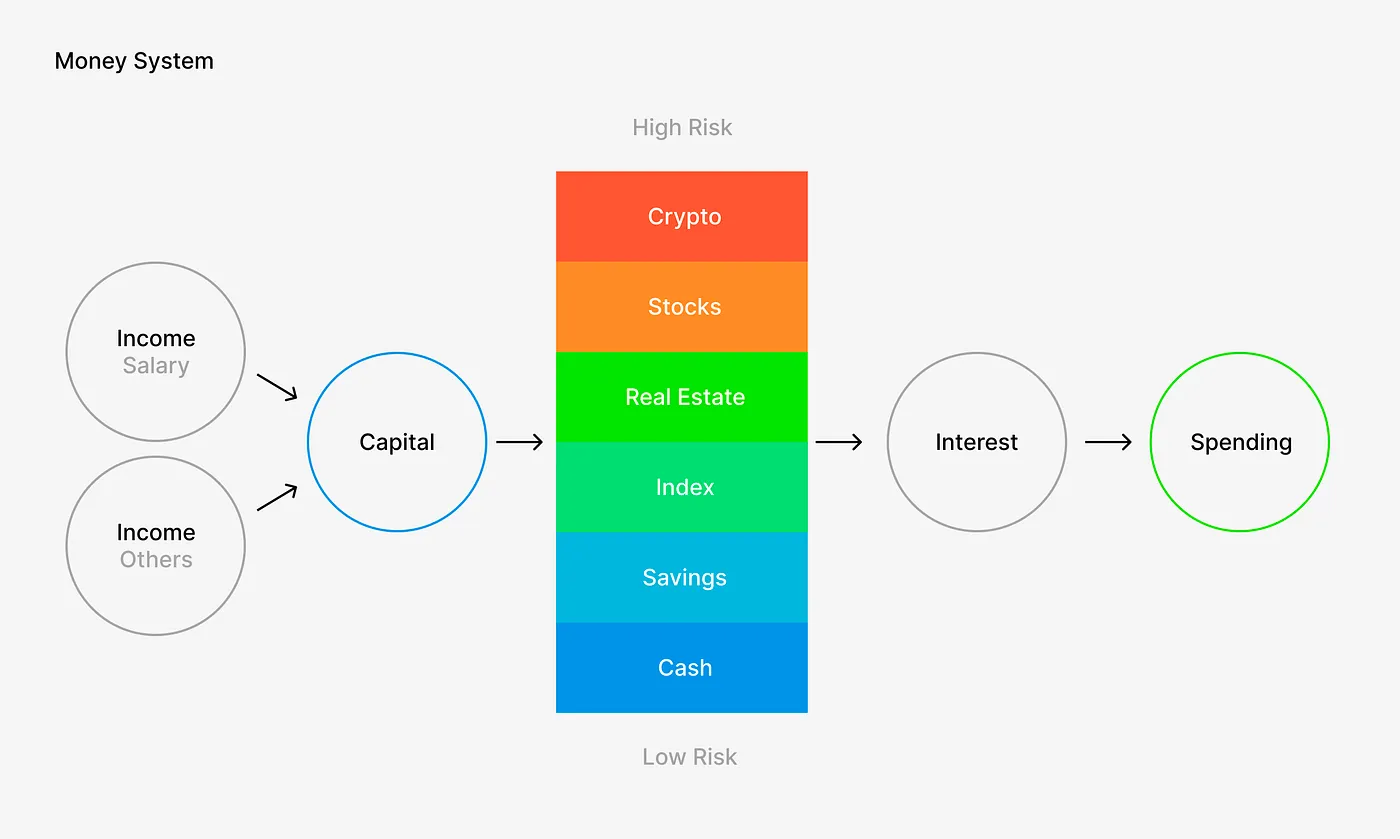

This was my diagram from 2023:

Going through this process taught me a lot about securities, risk, time and a lot of other ideas about how to grow money. I cleaned up my accounts and put most of my money into long-term investments. Then I took on some debt to improve my savings before quitting my job.

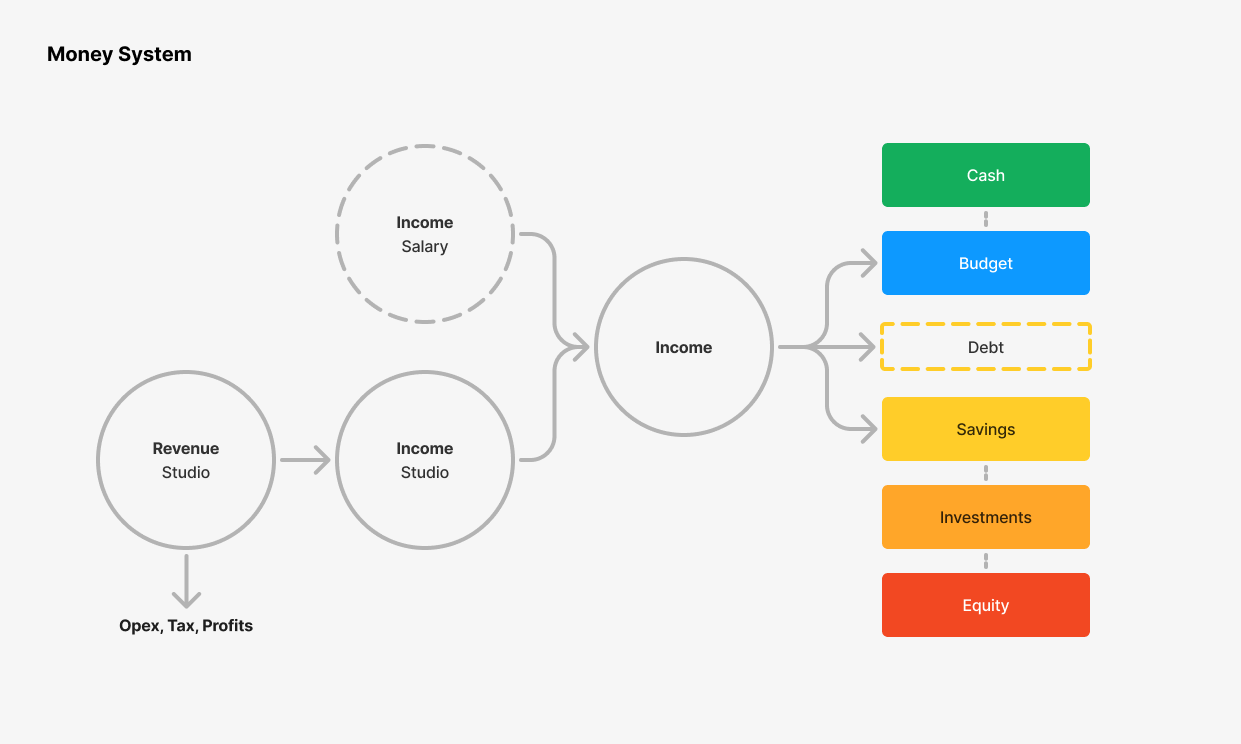

This is how I’m thinking about cash flow now:

- My main source of income is a job, but the studio pays me too.

- Combined income is split between budget, savings and debt.

- I use budget accounts to control spending by limiting cash.

- Savings have a cut-off point at which they go into investments.

- Investments are low to medium-risk e.g. ETFs or real estate.

- I fund high risk investments e.g. crypto from budget.

- Equity is a last line of defense.

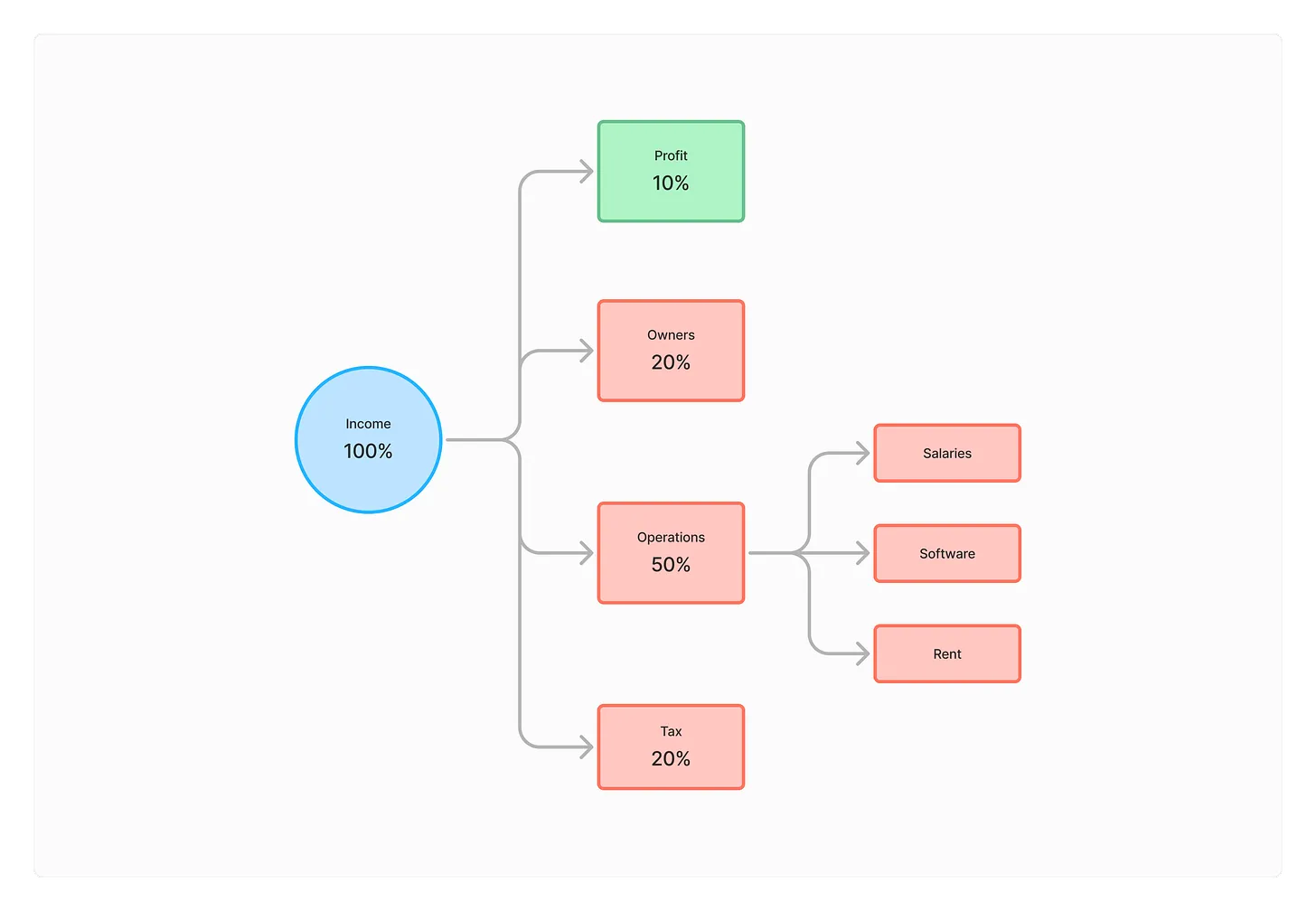

The studio, on the other hand, operates on the profit-first model: we take out a percentage of revenue and put it in a separate profit account. The rest is carefully allocated between owner’s pay, operating costs and taxes.

The idea is:

- We’re always making a profit.

- We take care of ourselves first.

- It constrains our operations to how much we’re making.

- It simplifies tax - we’ll never be owing.

We’re starting with an allocation that keeps the business running, but the goal is to grow our revenues to have sufficient operating capital for a long period of time. At this point, we can afford to allot higher percentages to other buckets.